Cryptocurrencies & IRA’s? Secure Alternative assets for retirement and savings funds?

Share

As of today, the United States IRA arena totals about 27 trillion dollars, with about 1 trillion dollars held in older IRA accounts by individuals who are currently involved in the trading of cryptocurrencies. However, many who are involved in this are exposed to unnecessary challenges and risks. Such as operating various cryptocurrency wallets, maneuvering about exchange platforms, protecting assets against hackers, and taking care of taxes. Which can be quite a hectic process, especially for United States citizens who are required to track every single cryptocurrency related trade that is made.

IRA’s eliminate many of these challenges. Though, perhaps the most appealing advantage relates to the simplification of cryptocurrency taxes. Traditional Ira’s allow you to deposit pretax income into an investment vehicle while taxes are only imposed when funds is withdrawn, and at a future rate. The rise in the popularity of cryptocurrencies over recent years has undoubtedly spurred a huge amount of pent up demand on behalf of IRA holders.

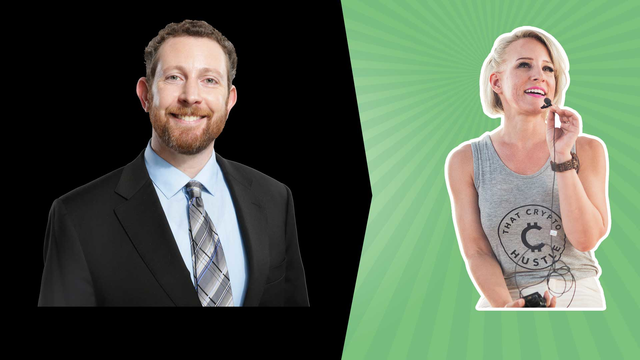

But can cryptocurrencies and IRA’s really mingle? According to today’s guest, Morgan Steckler, the CEO of iTrustCapital, one of the few regulated cryptocurrency IRA firms in the space, the answer is yes. iTrustCapital solves a lot of challenges in the retirement space when it comes to investing in cryptocurrencies such as legality issues, set up difficulty, high costs, and liquidity problems. Their platform operates 24/7 and caters to not only cryptocurrencies but as well as assets such as gold and real estate.

Time stamps:

1:16 How do cryptocurrencies and IRA’s mix together?

06:25 Handling cryptocurrency gain taxes.

08:06 IRA investments in the market today.

09:29 How is iTrust Capital able to maintain competitive rates.

10:51 What if someone is invested in iTrust capital into crypto and the assets cease to exist?

14:31 How could freelancers and gig workers.

17:07 Future plans of iTrust.

19:09 How to research cryptocurrencies IRA’s, and how to pick which crypto to invest in?

Find Morgan Steckler and iTrustCapital at:

Website: https://itrustcapital.com/home

Twitter: https://twitter.com/itrustcapital00?lang=en

LinkedIn: https://www.linkedin.com/in/mrmorgo

FOLLOW US ON SOCIAL MEDIA:

Twitter: @ThTCryptoHustle

Facebook: /ThatCryptoHustle Group: / Groups/ThatCryptoHustle

Instagram: @ThatCryptoHustle

YouTube: /ThatCryptoHustle

Telegram: https:/t.me/thatcryptoH